Some Ideas on How to Access Texas Bankruptcy Records You Need To Know

The Main Principles Of How to Get Copies of My Bankruptcy Paperwork

Many individuals wish to get a copy of their personal bankruptcy discharge documents and other insolvency documentation, and there are numerous reasons. Possibly you require your complete insolvency apply for your records, or you're wanting to request a brand-new task and need a copy of your discharge documents. Frequently a debtor will need access to their insolvency records to correct their credit report after their case is released.

It is crucial to keep a copy of your bankruptcy case. Speak with an experienced lawyer for legal recommendations post-discharge. Getting legal recommendations from an experienced bankruptcy attorney is constantly important. In Look At This Piece , they can review your case file if questions develop after discharge. An insolvency legal representative can help you get insolvency records for you records and future usage.

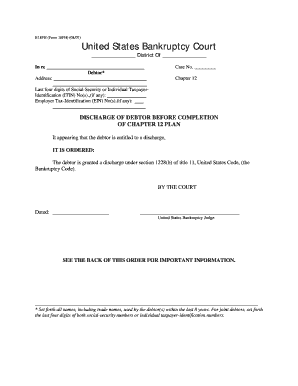

Having a copy of your bankruptcy records can be really handy in case you get sued on a debt that needs to be released or require to dispute a discharged debt with the credit reporting companies. Table of contents A bankruptcy discharge order frees the debtor from personal liability for numerous types of financial obligation.

A lender can not gather upon a debt when the personal bankruptcy court discharges it in either a chapter 7 bankruptcy or a chapter 13 insolvency. For this factor it is essential to keep a copy of your bankruptcy discharge. If you lost or lost your copy you must try to get a copy of your personal bankruptcy records.

Getting My Bankruptcy Information - Delaware Division of Revenue To Work

Often when there are mistakes on a credit report. Credit reporting agency requirements frequently require a copy of the discharge to make required modifications. When the personal bankruptcy court problems a discharge order for unsecured debt, most if not all credit card debt, medical debt, and other unsecured types of financial obligation can no longer be gathered upon by your lenders.

A debtor will wish to keep evidence of their personal bankruptcy filing if a credit seeks to gather on an unsecured debt after the insolvency is completed. Your insolvency records will consist of all of the financial institutions you owed money to. It will also include a copy of your discharge order. Protected financial institutions are dealt with in a different way after a discharge order is released.

UNDER MAINTENANCE